Home » Investment Banking Salary And Bonus: The Ultimate 2022 Report

If you’re interested in investment banking, you’ve probably wondered at least once how much you’ll get paid by working in this industry.

There are a lot of articles online that share some numbers on investment banking compensation. The problem is: these numbers are either massively outdated, or they don’t rely on high-quality data.

In this article, you’ll find a detailed breakdown of salaries and bonuses in investment banking in London.

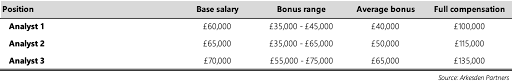

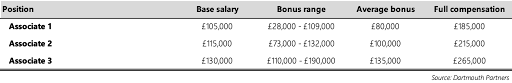

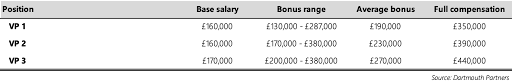

The data we’ve used to build these compensation tables come from high-quality sources, including Arkesden Partners and Dartmouth Partners – two premier hiring companies with a strong focus on investment banking.

These numbers are based on insider insights coming from Analysts, Associates, and Vice Presidents working for bulge-bracket investment banks (including Goldman Sachs, Morgan Stanley, and JP Morgan), and reflect the recent surge in base compensation that occured post-COVID.

Therefore, we can confidently tell you that the compensation numbers you’ll find below are the most reliable and accurate you can find (at least for London investment banking salaries).

Note that salaries in other European financial hubs, such as Frankfurt and Zurich, are comparable to London after currency translation.

We provide below a range of salaries that you can realistically expect by working for a top investment bank in London, by level of seniority, from Analyst to Vice President.

Compensation data based on reported salaries from: Goldman Sachs, JP Morgan, Morgan Stanley, UBS, Citi, Credit Suisse, Deutsche Bank, Barclays, and BofA Securities

Aurelian Tran is the founder of Alpha Lane and an ex-Goldman Sachs analyst who has spent 4+ years working in the investment banking industry.

He founded Alpha Lane to help students and young professionals achieve their highest professional ambitions, by securing offers at top-tier financial institutions.

@2022 Alpha-Lane. All rights reserved.