Home » Is Networking Important In Investment Banking?

In short: Yes. It is absolutely critical.

And just having a quick look at my story should be enough to persuade you of this truth.

I come from a non-target French university (most recruiters have never heard of it, and you probably haven’t either). My grades were good but not spectacular. I had zero family connections working in finance. When I was just applying like everybody else, I got rejected everywhere. I haven’t landed a single interview the first year I was looking for an internship.

The moment I started networking properly, interview invites were literally flooding into my mailbox.

Thanks to networking, I got my very first internship at Lazard. I worked on multiple healthcare M&A deals at German boutique Goetzpartners. I got a role at a top-tier hedge fund in London. And I joined Goldman Sachs as a full-time analyst.

I got nearly all my interviews thanks to networking. Without networking, I would probably be working as an auditor for a mid-sized audit firm.

Now, I’m not saying that you too will get an offer at GS if you learn how to network effectively. But if you want to obtain job interviews at the best, most selective investment banks in the world, you MUST become reasonably good at connecting with people who are working in the industry.

Unless you have an exceptional background (Oxbridge grad with pristine grades and student-athlete status), you probably won’t get any interviews at top banks, no matter how hard you try.

Below, I present the main reasons why networking is so effective at helping you secure job or internship interviews in investment banking. After that, I’ll explain to you how to network with bankers to get interviews.

This article is a must read if you’re currently struggling to obtain interviews.

Recruiters at elite banks receive tens of thousands of CVs every year. They can’t possibly go through all of them.

To help them select candidates, most banks use ATSs (Applicants Tracking Systems) – algorithms designed to screen thousands of candidates based on their school, major, grades, work experience, etc.

Only a minority of applicants have a profile strong enough to pass through the ATS without networking. But for the vast majority of candidates, applying on career portals will not be enough. Their CV won’t pass the algorithmic screen. And recruiters won’t even have a look at their CV.

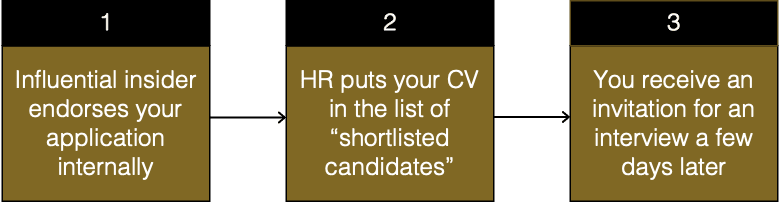

With that being said, there is a second tool recruiters use to greatly simplify their recruiting efforts: employee referrals. A referral is when someone working within the firm – typically a senior investment banker – endorses the application of a candidate internally.

When this happens, HR will acknowledge the endorsement, and put the referred candidate on a shortlist of candidates selected for first-round interviews. In other words, if you have a strong enough referral, you are pretty much guaranteed to have an interview.

Gaining the support of an influential investment banker is the best thing you can do to increase your number of interviews, because recruiters are relying heavily on employee referrals to make their job easier.

Just put yourself in the shoes of recruiters: if an MD is forwarding the CV of a candidate with a praising endorsement note, how would you react?

Well let me tell you. As a recruiter, you will think: “Ok, if John the rockstar M&A MD sent me the CV of this applicant, then he must be worth it”. And suddenly, the name of your school stops mattering that much…

Bottom line is: the internal referral is the most powerful recruiting mechanism you can leverage to secure interviews at leading investment banks.

And how do you get referrals? By networking. By getting in touch with senior investment bankers, and making sure they appreciate you enough to endorse you. I will tell you more about how to obtain referrals later in this article.

If you have had an interview already, you’re probably familiar with the question: “Why are you interested in our firm?” (e.g. Why Morgan Stanley?).

The goal of this question is to evaluate your interest for the firm, and most importantly, how you justify this interest. Most students provide BS answers to this question, by talking about the “special culture”, “the dealflow”, “the ranking in the M&A League Tables” and whatnot…

They’re doing it because they want to say something smart, not being aware that they mostly sound desperate.

Listen, the best, most effective thing you can do to prove your interest in the firm, is to connect with their people. If you had a few phone calls with investment bankers working at JPM, recruiters will deduce that you’re serious about starting a career there.

Because you were willing to do what most candidates don’t dare to do: PICK UP THE PHONE AND START DIALING! (I had to use this quote, for those who have the reference… More seriously, it shows that you are willing to get out of your comfort zone by reaching out to bankers and learning more about their job).

That’s why IB recruiters frequently organize networking events to meet candidates. Those who have the gut to approach employees and who are prepared enough to ask intelligent questions are typically the ones who make it to the next round.

And that’s why you need to network aggressively with these people. The more bankers you know, the more favorable the recruiters will see you. And the higher your chances of being invited to interviews.

Before I tell you how to network with bankers to secure job interviews, you first need to understand what networking really means. There are many articles online that massively overcomplicate the subject. Here, I will make it as simple and practical as possible.

So, what is networking? In one sentence: networking is about connecting with people in a position of power, and making them like you enough to be willing to help you if needed. That’s it.

Networking, when applied to your search research, has one purpose only: helping you secure endorsements from bankers. But to get their support, they need to like you. And for them to like you, you need to build a genuine connection with them.

How did I get my first interview at GS? I networked with someone who was highly placed at the firm. An MD with decades of experience. I approached him via email, jumped on a call with him, built a connection, and later leveraged this connection to obtain a referral from him.

Some may say that this approach is insincere or manipulative. But it doesn’t have to be. Yes, you’re doing this with a goal in mind, but if you’re genuinely taking an interest in the person, and if you sincerely appreciate your interactions, there is nothing to be ashamed of. This is how the game works and they know it. In fact, they very likely did the same to get their job.

So remember: networking is just about building connections with people in a position of power, and using these connections to obtain job interviews.

Building a sincere connection with someone is more of an art than a science, but we will provide some tips on that later on.

Now, we’re going to discuss the main ways you can network with bankers. Both have pros and cons, and if you want the best results, I’d recommend using a combination of the two.

The first way of networking is the one most students can think of: going to networking events organized by the largest banks.

Goldman Sachs, JP Morgan, Citi, and all the other major banks frequently organize recruiting events in large cities, in which applicants have an opportunity to interact with recruiters and bankers.

If you are relatively good at presenting yourself and engaging with strangers, these events can be a time-effective way to build your network.

I know plenty of students who obtained referrals (and later interviews) by attending these events. Connecting with recruiters at these events is one of the traditional ways to get your name on the list of shortlisted candidates, so you should definitely consider this option if you are relatively at ease with meeting new people (I say relatively because I know that these events can be stressful for most students).

That being said, these events are extremely competitive. There will be a lot of candidates for very few recruiters, meaning that applicants have to compete for the recruiters’ attention (which can sometimes lead to pretty awkward situations)…

Due to the very social nature of the event, students who are highly extroverted and easy to talk to generally have a clear advantage over quieter, shyer candidates. It may seem unfair but that’s just the way it is, in my experience.

PROS:

CONS:

This strategy, applied correctly, is by far the most effective way to secure referrals and job interviews. I’ve relied almost exclusively on this strategy to obtain the majority of my interviews at top-tier investment banks.

In principle, it is relatively simple: you send cold emails to senior investment bankers, with the goal of organizing a call with them.

Once you have a call, your objective is to connect with them strongly enough to make them willing to give you a referral.

Do dozens of these calls, and you’re pretty much guaranteed to have referrals at some point which will help you land interviews at the top banks. Nearly all my interviews came from using this extremely effective strategy.

Now, while it may sound simple in theory, there are many things you need to know to apply it correctly. What specific emails should you send? What is the best way to ask for a call? Once you have a call, why do you talk on the phone to build a genuine connection with the banker? And most importantly, how do you ask for a referral?

It took me YEARS of trial and error to figure this all out. Fortunately, you won’t have to go through the same pain. I’ve created an online course in which I explain my cold emailing process, step by step.

In this course, I reveal: what exact emails you need to send to get networking calls, what to say during these calls to connect with bankers on a personal level (including smart questions that make them engaged every single time), and how to ask for referrals, both directly and indirectly.

I share the exact same cold emailing & networking system I’ve personally used to land dozens of interviews at bulge-bracket banks and elite boutiques, despite coming from a non-target school.

If you currently struggle to get interviews, I guarantee you that this course will massively help you, if you follow my advice. You can learn more about it here.

Now, let’s talk about the pros and cons of this alternative networking strategy.

PROS:

CONS:

As mentioned, it’s best to use a combination of these two strategies if you want the best results. That being said, the second strategy is sufficiently powerful by itself to help you get interviews.

That’s why I recommend investing most of your time in sending effective, persuasive cold emails to secure networking calls with bankers.

If you want to know exactly which exact emails to send, and what to say on the phone to obtain referrals from senior bankers, check out our special cold emailing & networking course here.

Best of luck for your research.

Aurelian Tran is the founder of Alpha Lane and an ex-Goldman Sachs analyst who has spent 4+ years working in the investment banking industry.

He founded Alpha Lane to help students and young professionals achieve their highest professional ambitions, by securing offers at top-tier financial institutions.

@2022 Alpha-Lane. All rights reserved.